Why?

Lenders lack data and tools to properly assess new borrowers’ affordability, offering borrowers conditions that don’t match their financial capabilities

New borrowers lack financial awareness and education to assess if the repayment terms match their expected cashflow

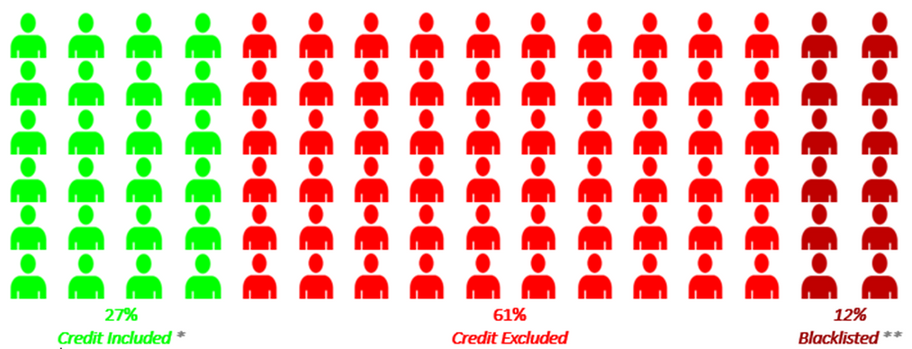

73% of Kenyans lack access to affordable credit to overcome cashflow needs

or are trapped in chronic indebtedness

The Challenge

Communities based lenders such as SACCOs and Chamas tend to offer more responsible and affordable loans leveraging borrowers’ social assets and trying to match loans terms to borrowers’ financial capabilities

Most SACCOs lack the data and tools to automate their credit underwriting processes

SACCOs’ credit underwriting process is labor extensive and therefore not scalable and less appealing for the younger generation

revolutionizes the traditional credit inclusion

works?

How

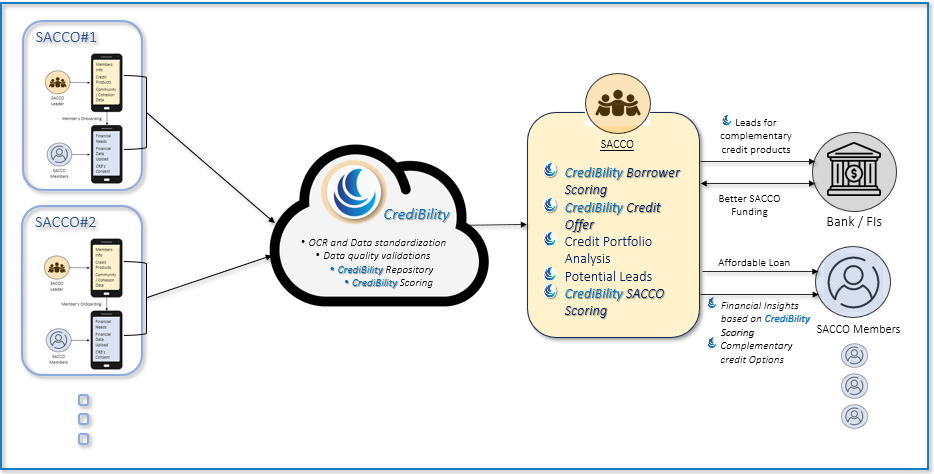

Collects alternative data such as: employment, financials, remittances, cashflow and objective community cohesiveness info

Aggregates the data from a large number of SACCOs, anonymizes and cleanses it

Analyzes the data in order to develop borrower’s affordability and creditworthiness

Returns a personalized borrower’s credit scoring, credit offer and financial insights for a better credit underwriting of the SACCO, based on the it’s credit policy

Member

- Access affordable and responsible loans

- Financial insights based on their Credibility Borrower Scoring

SACCO

- CrediBility Borrower Scoring & Offer - a reliable and trustworthy borrower’s risk assessment

- Better funding based on CrediBility SACCO Scoring

- Additional revenue based on leads to banks for complementary credit products

Bank

- Receives leads for complementary credit products based on CrediBility borrower scoring,

- Offers lower risk funding to SACCOs based on CrediBility SACCO scoring

Advanced credit scoring as a service for SACCOs

that leverage their traditional competitive advantage

SACCOs can enjoy their automatic underwriting within 10 days and without costs

- SACCOs share only raw data easily (API, csv/Excel or digital form)

- SACCOs define their members’ access to complementary credit products from banks

- Online training

- SACCOs get access to a generic scoring and credit offer without costs, fees are charged only from bank referrals

- Value added services for tier 1 SACCOs: bespoke scoring, customized credit offering, tailored configuration, reports and risk analysis

Innovation

Leverages the community’s social assets and additional data points from various sources

Unlike most credit scorings, CrediBility calculates not only the borrower’s creditworthiness but also its financial affordability, and a responsible personalized credit offer

Unique business model - SACCOs share only anonymized data but still control when they share sensitive personal data, therefore still maintain their competitive advantage

CrediBility’s robust repository enables continuous improvement of credit scoring and value propositions based on large number of SACCOs anonymized data analysis

Trustworthy and reliablerisk assessment by applying advanced data cleansing algorithms, models back-testing and external third party validation

Promotes borrowers’ financial education and credit awareness by sharing with them a transparent scoring and insights based on it